Explaining a margin variation between actual and budgeted results for last month is essential. While we’ve discussed how to explain revenue variation previously, let’s delve into margin variance.

There are several approaches, but here’s what I find most useful:

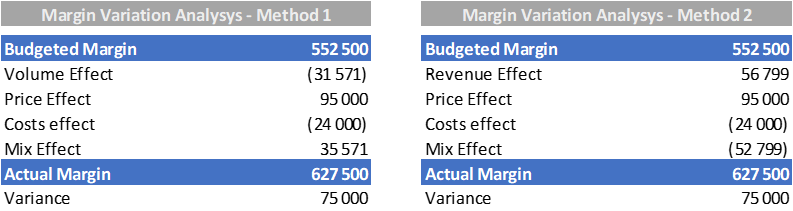

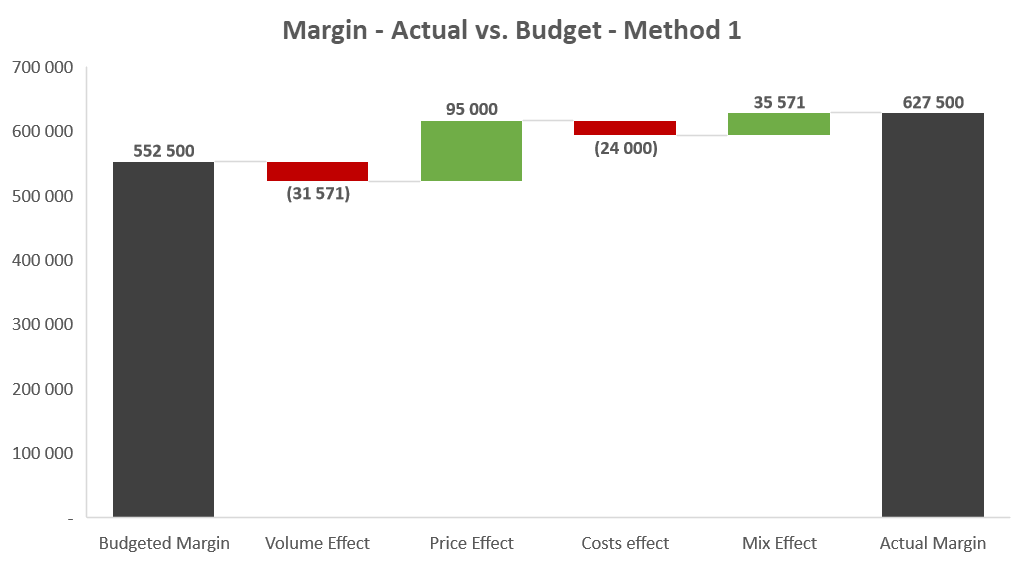

- Method 1: Volume & Unit Margin

Volume Effect = (Actual Volume - Budgeted Volume) * Budgeted Unit Margin

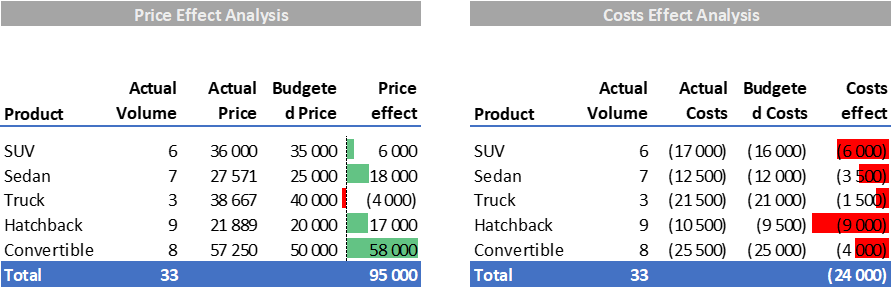

Price effect = Sum of Price Effect on all products

Costs effect = Sum of Costs Effect on all products

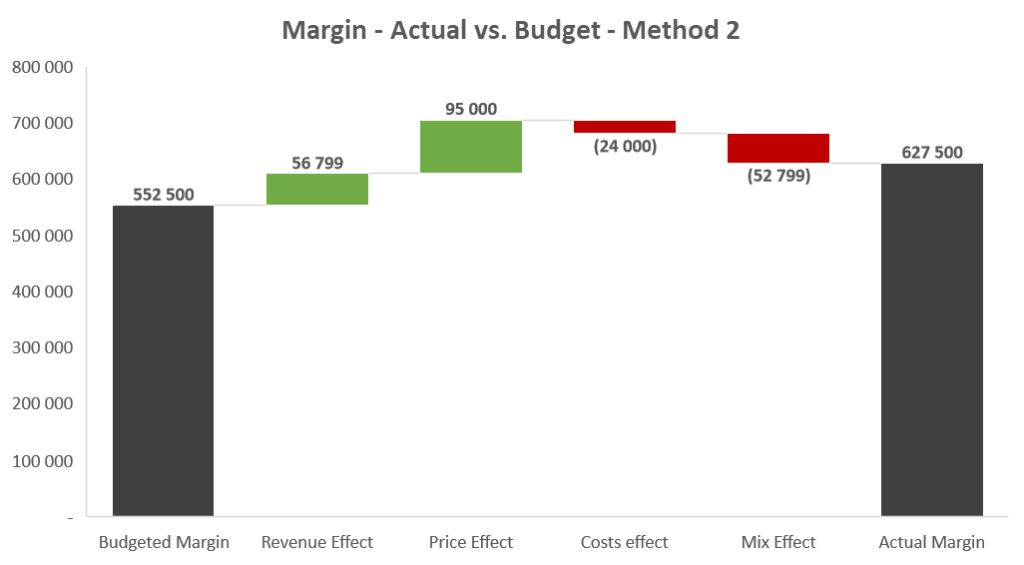

Mix effect = (Actual Unit Margin - Budgeted Unit Margin) * Actual Volume - Price effect - Costs effect- Method 2: Revenue & Margin Rate

Revenue Effect = (Actual Revenue - Budgeted Revenue) * Budgeted Margin Rate

Price effect = Sum of Price Effect on all products

Costs effect = Sum of Costs Effect on all products

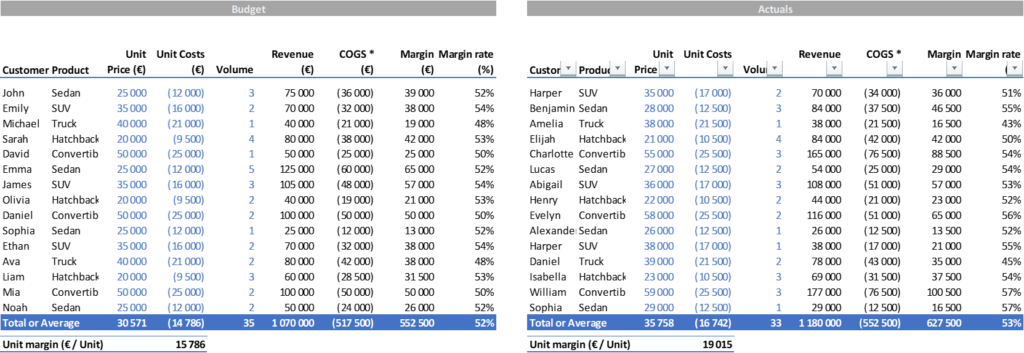

Mix effect = (Actual Margin Rate - Budgeted Margin Rate) * Actual Revenue - Price effect - Costs effectLet’s examine an example using both methods:

What can we infer from this example?

- Both methods yield different results as the volume is lower (-2 cars) and the revenue higher (+€110 k)

- Method 1 is more representative for a range of similar products with unit margins in a reasonable range. If you sell screws and nails along with cars, the second method will be more suitable.

- Method 2 is preferable when dealing with products with varying unit prices, focusing on revenue and margin rate rather than volume and unit margin.