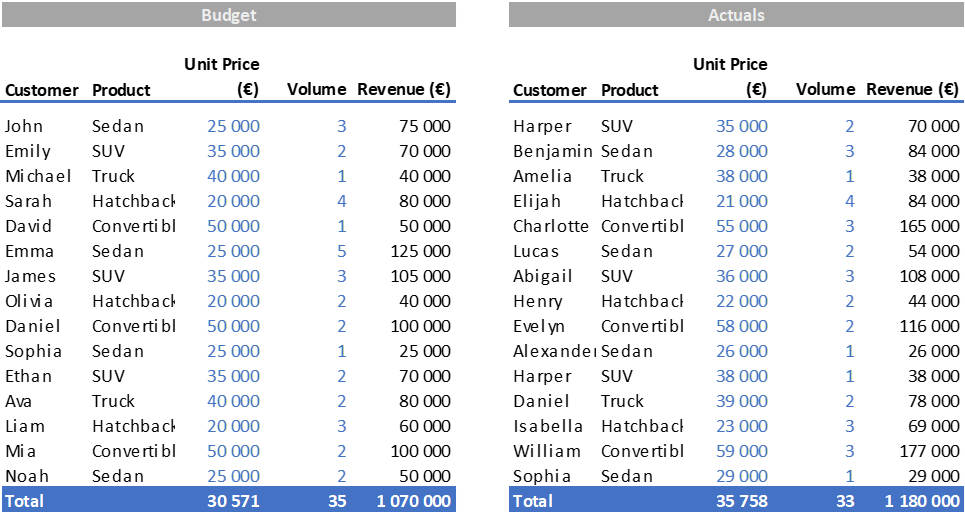

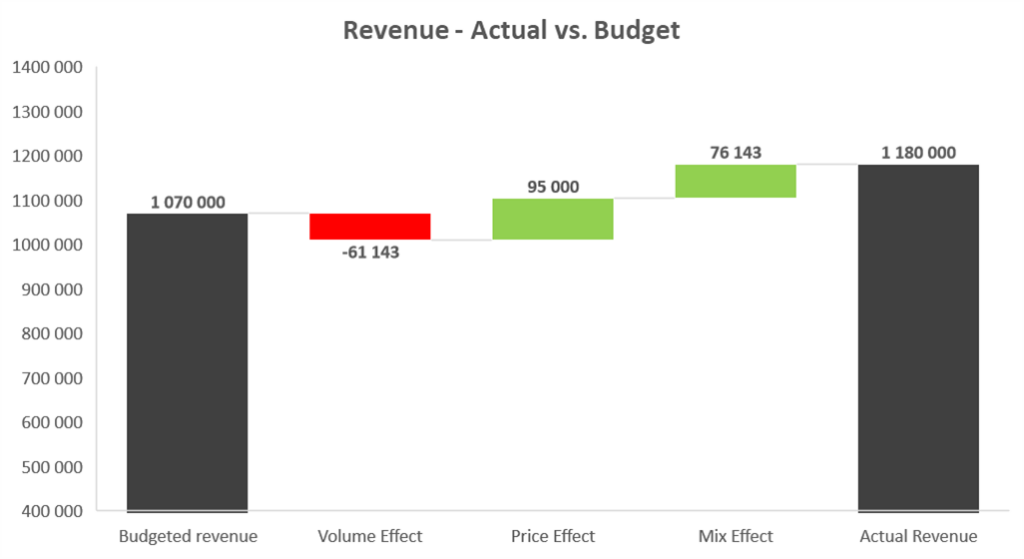

Let’s say your revenue budget for last month was €1,070k, but you exceeded it by €110k. Now, you need to explain the main reasons for this variation to your shareholders.

Here’s how to break it down:

- Volume Effect:

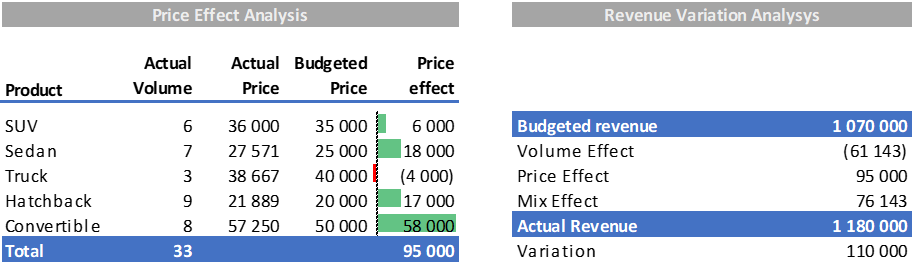

Calculate the difference between actual and budgeted volumes, multiplied by the budgeted unit price

(Actual Volume - Budgeted Volume) * Budgeted Unit Price- Price Effect:

For each product, compute the difference between actual and budgeted unit prices, multiplied by actual volumes. Sum up the price effects for each product. Bear in mind not to add a price effect for a product if the Budget did not anticipate this product to be sold.

ΣAll products (Actual Unit Price - Budgeted Unit Price) * Actual Volume if Budgeted Unit Price ≠ 0- Mix Effect:

Determine the overall price effect minus the sum of price effects for each product. This reveals the impact of changes in product mix.

(Actual Unit Price - Budgeted Unit Price) * Actual Volume - Price EffectNow that you have the figures, focus on explaining the significant impacts only.

Here’s an example to illustrate:

Now you can explain the price effect of the convertible model (impact of +€58k) and the mix effect due to you selling more convertible models (which has the higher unit price) than expected (8 vs. 5).